- Buyside Hub Newsletter

- Posts

- Buyside Hub EOY Update

Buyside Hub EOY Update

Increasing Access for the SellSide and raising pricing for non-contribution

Welcome back. Hope everyone is having a good time wrapping up the year and is ready for 2026. Thank you for supporting Buyside Hub during our first year in business. We’ve doubled the platform over the past 4 months and are extremely excited for next year.

We’re here to support you over the coming months as 2026 Bonus Season kicks off.

Going into 2026, we’ve made some access and pricing changes that best supports the business for sustainable, future growth. If you are a high-earning Buyside professional who fully contributes, then nothing has changed. But for everyone else, there’s been some updates:

Longer Access for the Sell-Side, Higher Pricing for Non Contribution/Access Gaps:

Effective, this week we’ve rolled out a new access length plan that’s based on a variety of factors including whether you’re buyside or sell-side, your compensation level, and the amount of granularity you provide in your submissions.

We’ve accidentally become a massive hub of Investment Banking data as well, so instead of our initial plans of making the Sell-Side pay/giving them 1 month of access, we are extending this out to 3-6 months. We want to reward detailed contributions and recognize sell side professionals for their efforts.

So for contributors, we’re giving longer access for people who contribute in detail, but less access mainly for people who speedrun through the process. The Buyside can earn up to 12 months of free access of contributing, but future access ranges will be in the 6-12 month range.

On the paid side, we ended new monthly subscriptions and are instituting a quarterly plan instead. We have also raised pricing for new annual plans materially.

When I started Buyside Hub, it was mainly meant to be for professionals, because I generally thought there were user maturity issues with sites like WSO. Generally, we get some straight forward submissions that allow for easy and free approval. But when we run into submission shenanigans, it’s generally from students or analysts who think a robot is just going to let them waltz onto the platform. For example, they will type in “DAGSDSJFSI”, “N/A”, or gibberish in their firm culture submission responses. 90% of submissions are pretty straight forward and professional, but for the other 10%, tolerance for not following our process ends today.

What’s really important here is that you provide your LinkedIn address or Investment Team Bio, provide your firm name, and answer the questions we have around firm culture and interviews.

Contributing Plans:

It is really important to fully go through our process so we can verify your background. We might ask that you email us via [email protected] if we need more info.

Interns/Students: 1 month of access for verified contributions.

Junior Sell Side Professionals: Up to 3 months of access for verified contributions.

Lower quality responses may garner just a month of access instead of 3 months

We generally view CorpDev as Buyside, but Consulting and other Corporate roles as non-Buyside positions

Senior Sell Side Professionals: Higher-earner sell-side professionals who answer fully will earn up to 6 months of access

We have regular Director and MD submissions and want to reward these folks for their contributions to the community

Buyside Professionals: We have full discretion on whether you get 6 or 12 months of access, but it’s very dependent on your submission

Lower quality responses will garner 6-9 months of access instead of 12

Professionals that are more junior or lower on the comp totem pole will more likely be granted 9 months

Professionals that are high-earners and answered fully will be granted 12 months

We are also looking for data from the past 12 months, as opposed to older data < 2024

What matters the most here is that this is a two-way street, we need to verify your background as part of our approval process and our inability to do so will lead to a rejection. Making our life more difficult in approval will also ding you.

Accurate submissions are crucial, so if we suspect submissions are inaccurate or not following our submission process, we can elect to suspend or terminate your access if you violate our terms and conditions. That is the last thing we want to do of course. So please use your best judgment on whether a paid plan is a better fit for you than contributing.

Paid Plans:

For non-contributing or people on shorter plans, we have quarterly and annual options:

Quarterly Access: $75.99 every 90 days

this is actually cheaper than the $29.99/month plan we are discontinuing, but we’re done with monthly plans and onto more sustainable and higher-ticket access plans

Annual Access: $149.99 every year

If you are already on an Annual plan, your next renewal will have a $105/year price point, and then the following year you will be at the regular price point of $149.99

Adding Profile Preferences:

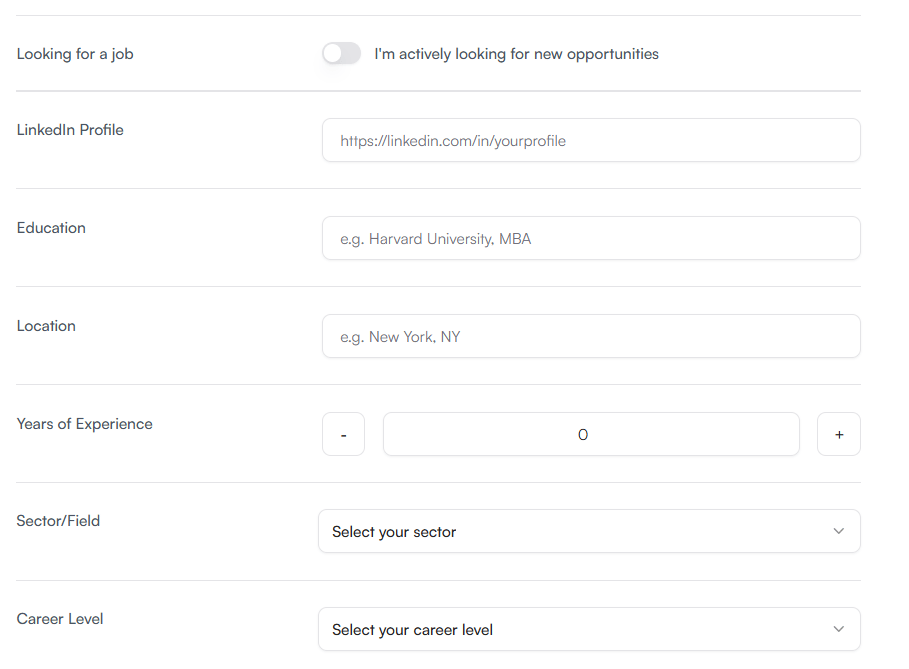

As a reminder, from the last email, we added a profile preference feature for everyone. To help drive roles in front of the right people, we are adding profile preferences, which is located on your profile page in the “my details” section. You can toggle on if you’re actively looking for new opportunities and include key details like your LinkedIn profile and preferences such as city and industry. This is all private and anonymous of course and is meant to help us develop a pool of folks actively looking.

The LinkedIn profile part is crucial - by now including this to your profile, you don’t have to re-add your LinkedIn when you go to contribute new compensation data. This way we can verify your background faster.

Secondly, in the Billing section we now include how long you have access for. When your compensation data is approved, you’ll receive an email letting you know how many months your access is for, but this is a new way to check on the length of your plan.

(As the Founder, I’m on the 300 month plan haha)

Work with us in 2026:

Jobs: We are ready to do materially more job placements and recruiting over 2026. With the addition of profile preferences and a strong inflow of Buyside professionals, Investment Banking Analysts, and Investment Banking Summer Analysts over the past few months, the candidate pool is quite robust in nature.

In addition, the High Yield Harry socials and newsletter audience is incredibly strong with 380,000 followers across Instagram, 170,000 followers across X, and 120,000 readers across newsletters.

Please reach out to [email protected] to discuss your hiring needs.

Our highlighted Jobs:

Partners Group is hiring a PE Associate (Colorado)

PIMCO is hiring a Private Credit Associate (London)

Antares is hiring a Private Credit Analyst (Atlanta)

Goldman Sachs is hiring a Wealth Investment Solutions Associate (NY)

BlackRock is hiring a GIP Capital Formation Associate (NY)

Talk soon!

Contact Us:

For your hiring needs and any other needs: [email protected]