- Buyside Hub Newsletter

- Posts

- Buyside Hub Monthly Update

Buyside Hub Monthly Update

Shipping Profile Preferences

Harry, here.

I wanted to shoot over an update on a few things, including a Profile Preferences feature we just launched. Since, we last talked, the platform has continued its ~1,000 new users a month cadence. It has been paramount for me over the past 4 months of continue adding high-earning professionals to the platform to enhance the overall experience for existing and new users.

As a refresher, last month we shipped Interview Questions - a new way to aggregate thousands of valid submissions from professionals who shared what they experienced in Private Equity, Credit, Asset Management, Investment Banking, and other Interviews.

Adding Profile Preferences:

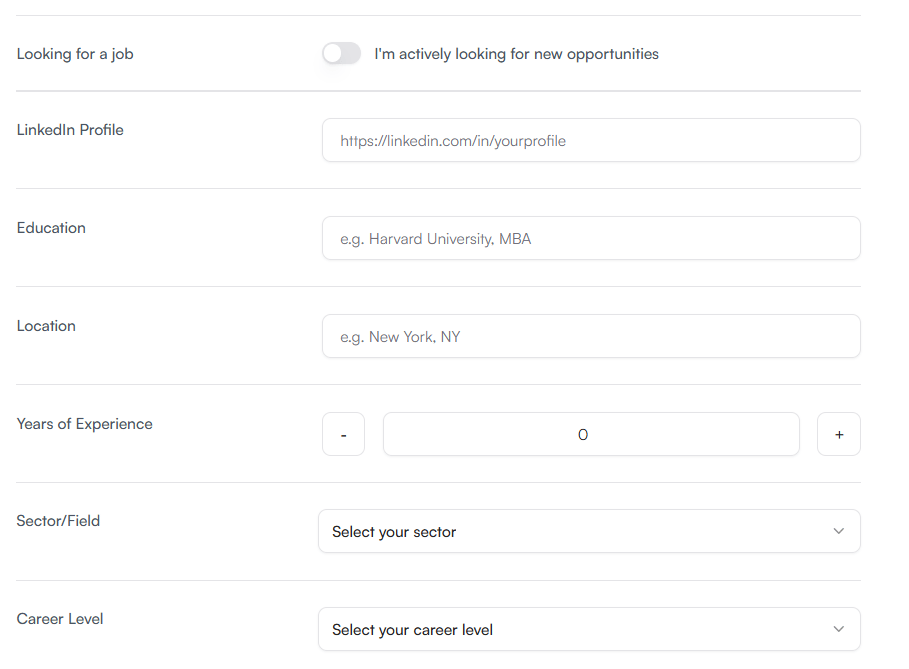

To help drive roles in front of the right people, we are adding profile preferences, which is located on your profile page in the “my details” section. You can toggle on if you’re actively looking for new opportunities and include key details like your LinkedIn profile and preferences such as city and industry. This is all private and anonymous of course and is meant to help us develop a pool of folks actively looking.

The LinkedIn profile part is crucial - by now including this to your profile, you no longer have to re-add your LinkedIn when you go to contribute new compensation data. This way you’re able to go through the compensation submission process and we can verify your background faster.

Your LinkedIn profile or Investment Team bio is a crucial part of approving your data and getting your access. If we are unable to verify your background, then we’re unable to grant you access. If it takes us a while to verify your background because you didn’t provide a link, then we might ding you and give you fewer months of access than you were initially eligible for. So having this profile link now established is a great way to help save time for everyone.

Secondly, in the Billing section we now include how long you have access for. When your compensation data is approved, you’ll receive an email letting you know how many months your access is for, but this is a new way to check on the length of your plan.

(As the Founder, I’m on the 300 month plan haha)

We are gearing up for a big 2026:

Jobs: We are ready to do materially more job placements and recruiting over 2026. With the addition of profile preferences and a strong inflow of Buyside professionals, Investment Banking Analysts, and Investment Banking Summer Analysts over the past few months, the candidate pool is quite robust in nature.

In addition, the High Yield Harry socials and newsletter audience is incredibly strong with 380,000 followers across Instagram, 170,000 followers across X, and 120,000 readers across newsletters.

Please reach out to [email protected] to discuss your hiring needs.

Compensation: As we near bonus season, we think our reports are going to be unparalleled. What amazed us when launching Buyside Hub was how poor and limited other sources were and how recruiters had a much worse quantum of datapoints than you would imagine. The one-year anniversary of Buyside Hub is in January and we anticipate a heavy inflow of new and refreshed datapoints as comp numbers drop. Our Compensation Reports will be dropping March and coupled with our Industry Analytics and Individual Compensation dashboards, we want to be your sole-source provider of making you’re getting paid appropriately and you’re benchmarking pay appropriately.

Longer Access for the Sell-Side, Higher Pricing for Non Contribution/Access Gaps:

We are close to rolling out a new access length plan that’s based on a variety of factors including whether you’re buyside or sell-side. your compensation level, and the amount of granularity you provide in your submissions.

We will be phasing out monthly plans soon and introducing quarterly (90 day) plans. Quarterly plans are perfect for people who want short term access and for those on <6 month access plans that want to bridge the gap between their next submission. Annual plans will be going up materially, as we want to incentivize and reward submissions. Anyone on an annual subscription currently won’t see a 100% pass through in price in their upcoming renewal, but will see it in their following renewal cycle. More on that in December.

Our highlighted Jobs:

Fortress is hiring a Private Credit Product Specialist (New York)

Blue Owl is hiring a Digital Infrastructure Associate (Chicago)

Solomon Partners is hiring an IB Analyst (Chicago)

Houlihan Lokey is hiring an Associate for its Healthcare Group (Chicago)

Oaktree is hiring a Senior Associate/AVP for PE Product Strategy (LA)

ICG is hiring a Direct Lending Associate (London)

Franklin Templeton (Alcentra) is hiring a Secured Loans Intern (London)

Enjoy your weekend!

Contact Us:

For your hiring needs and any other needs: [email protected]